Why Are AI Companies Choosing Natural Gas Over Solar and Batteries?

“It’s the economy stupid” by James Carville in 1992,

As AI infrastructure expands at an unprecedented pace, companies are demanding massive amounts of reliable power. Many are turning to natural gas, with some viewing it as a bridge to nuclear energy, while others see it as a long-term solution. This shift has sparked criticism from environmental advocates, who question why AI companies aren’t prioritizing solar and battery storage instead.

To explore this, let's examine a real-world case study: Energy Transfer’s recent deal to supply CloudBurst with 1.2 GW of electricity—24/7, 365 days a year. Using Energy Information Administration (EIA) data, I’ll compare the cost of solar-plus-battery storage versus natural gas for a facility designed to be self-sufficient (not connected to the grid).

The Bottom Line: Cost, Reliability, and Practicality

For those who want the key takeaway upfront:

If you were the CEO of CloudBurst, would you spend $1 billion or $20.8 billion for the same amount of power? Is the higher price worth it just for appearances?

The reality is clear—cost, reliability, and proven technology are driving AI companies toward natural gas.

The Rising Demand for Natural Gas

On November 7, 2024, Energy Transfer revealed it had received connection requests for over 90 power plants and data centers, potentially adding 16 billion cubic feet per day (Bcf/d) of new natural gas demand.

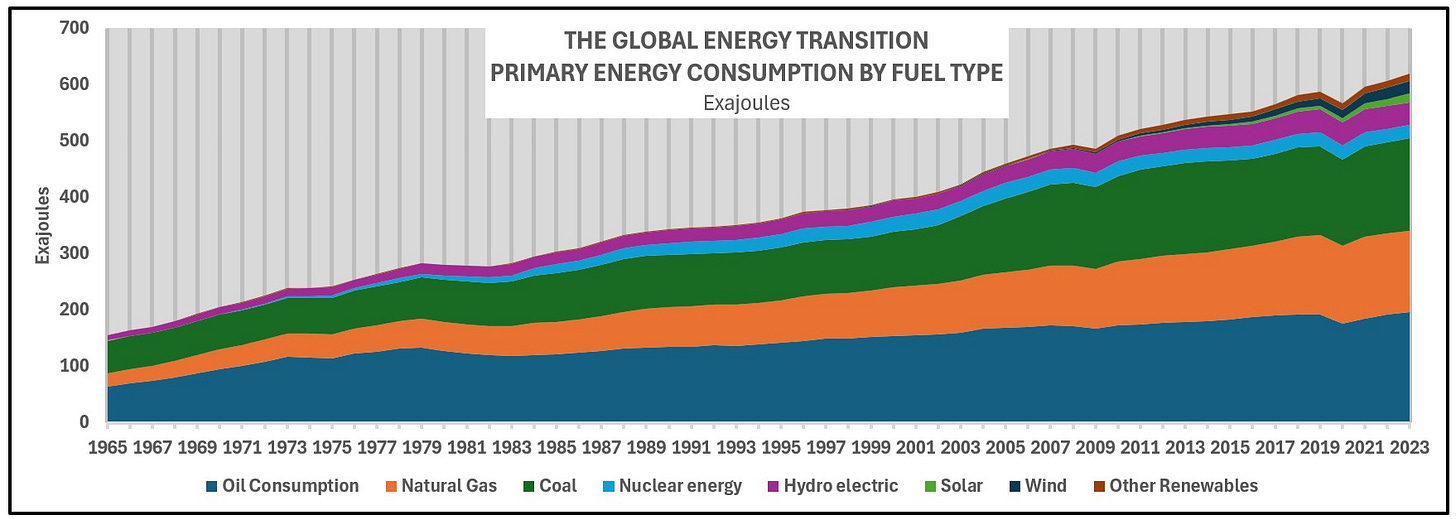

While reports from the International Energy Agency (IEA) highlights solar as the fastest-growing energy source globally, natural gas has steadily expanded for decades. According to the Department of Energy (DOE) data, natural gas has a compound annual growth rate of 3%, outpacing coal (2%) and oil (1%).

The data represented in the charts below both show that natural gas has grown far more than solar, both in the U.S. and globally.

Solar Plus Battery Design

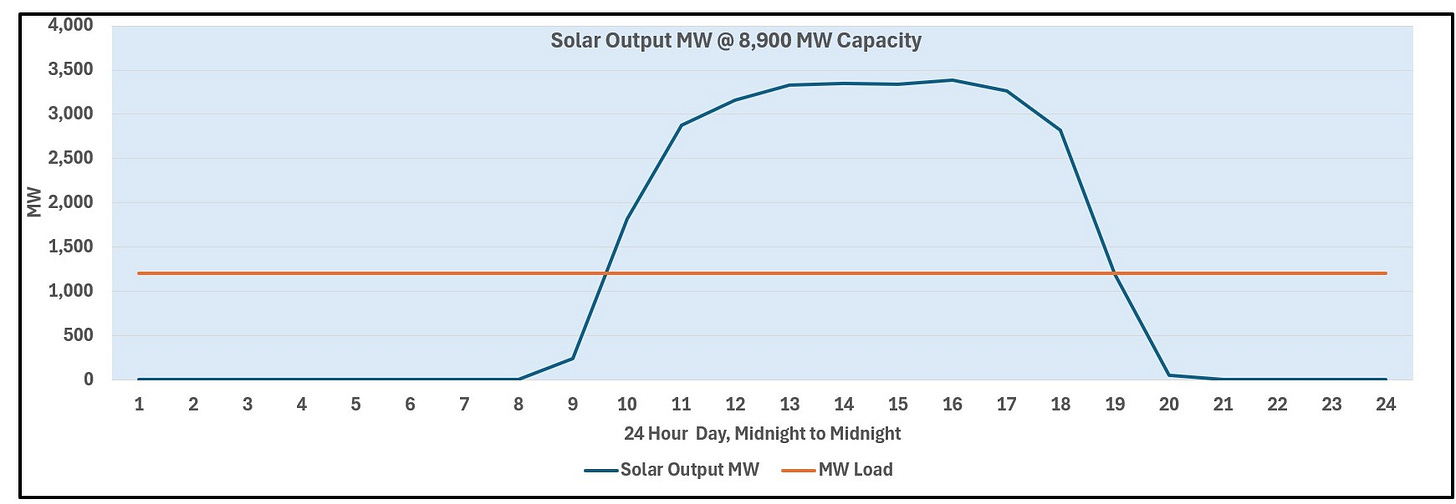

To model a solar-plus-battery system, I used EIA hourly data for February 16, 2025. I converted this into a daily energy profile to assess how much capacity would be required.

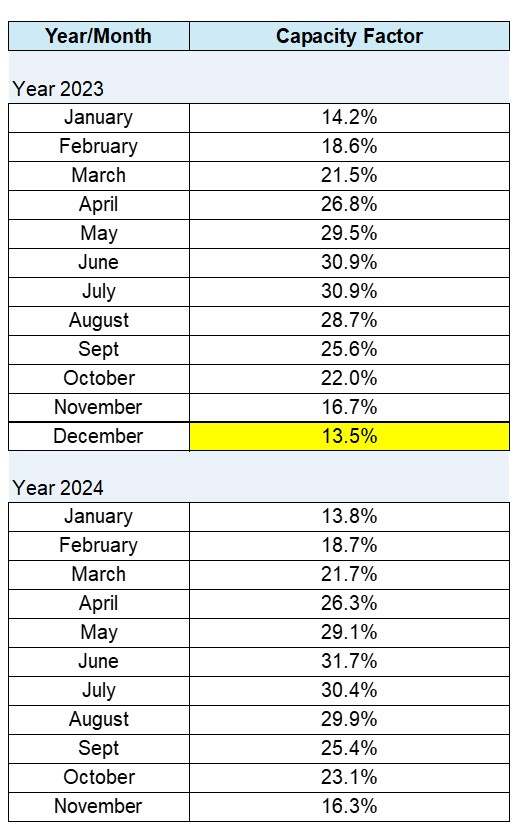

Solar output varies by state and season, but for simplicity, I used U.S. monthly averages from the EIA.

The lowest monthly capacity factor in the dataset was 13.5% (December 2023).

To generate 1,200 MW per hour continuously, the facility would need 8,900 MW of installed solar capacity—nearly 7.5 times the required output due to solar's limited availability.

Battery Storage Requirements

Since solar doesn’t generate power at night, batteries must store excess energy during the day to supply power after sunset. Assuming a typical day:

7:00 PM: Solar stops producing, and batteries must be fully charged.

7:00 PM – 9:00 AM: Batteries discharge 1,200 MW per hour to keep operations running.

9:00 AM – 7:00 PM: Solar must meet real-time demand and recharge the batteries.

This setup requires:

✅ 1,200 MW power rating

✅ 17,000 MWh of storage

Cost Breakdown

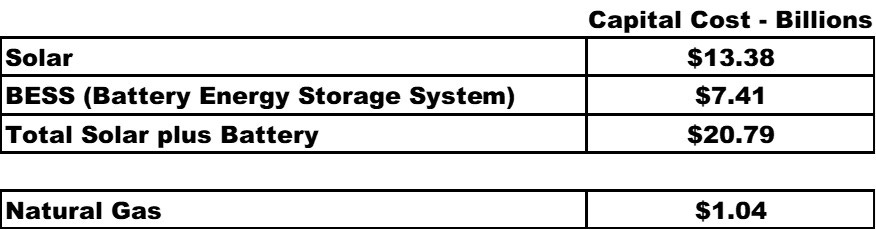

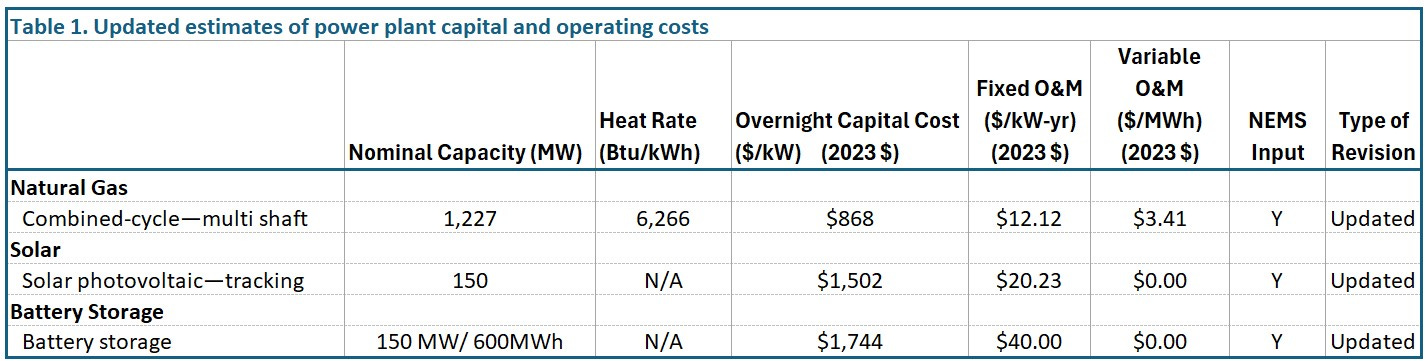

The EIA’s 2024 Capital Cost Report provides estimates for different power generation technologies. The main summary is Table 1 which shows the Capital Costs and Operating & Maintenance costs for the various types of generation. Following is Table 1 condensed to just the equipment types that we are discussing.

Key insights:

The report's capital cost estimates are based on nameplate capacity, not actual output.

Since solar operates at 13.5% capacity, its effective capital cost is 7.4x higher than the listed price.

Cost Comparison

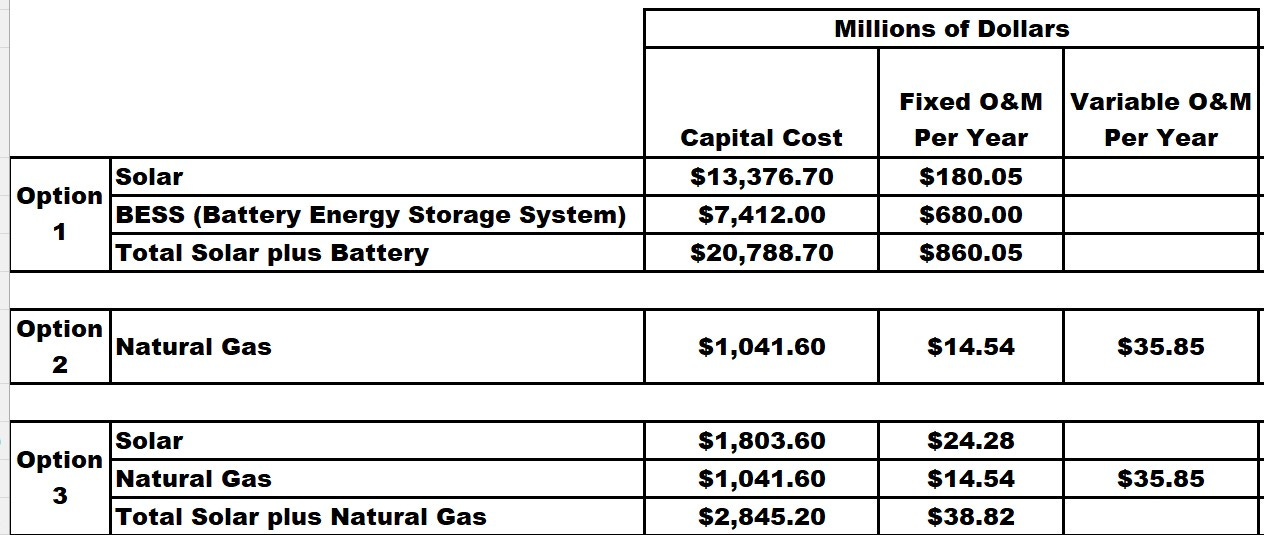

Using data from the EIA’s 2024 Capital Cost Report, here’s how the numbers compare:

Option 1: Solar + Batteries – $20.8 billion capital cost, $860 million annual operating cost

Option 2: Natural Gas – $1 billion capital cost, $50 million annual operating cost

Option 3: Hybrid (Solar + Natural Gas) – $2.8 billion capital cost, $74 million annual operating cost

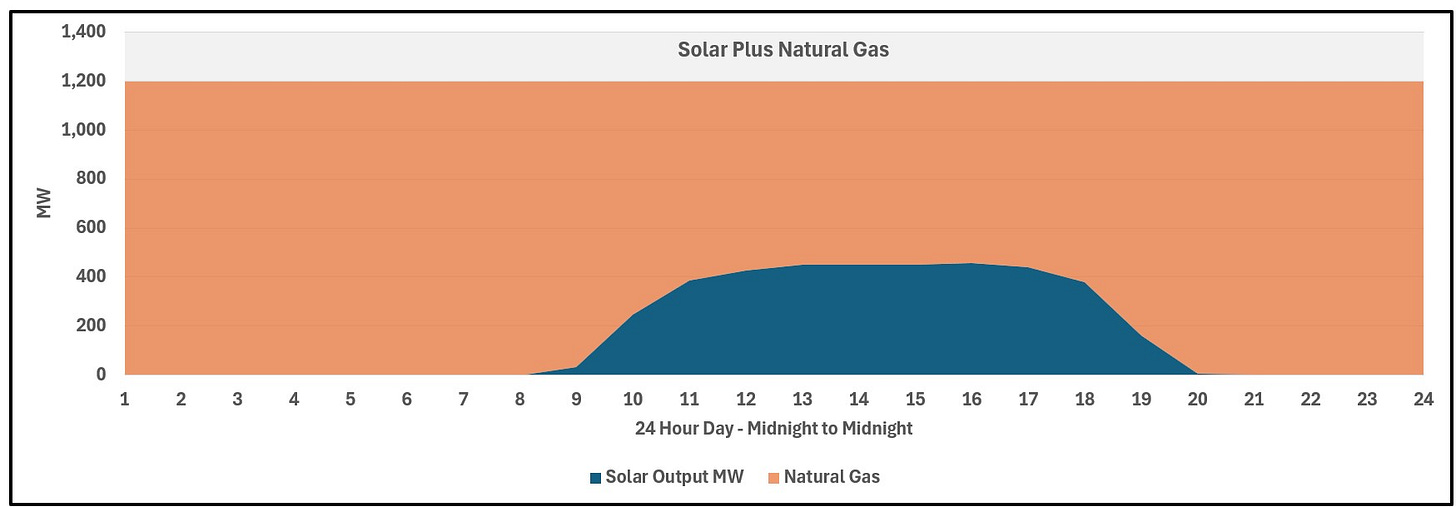

A hybrid approach would allow AI companies to "go green" without compromising reliability—though many people may not understand how capacity factors work, making the environmental impact seem larger than it actually is.

Important Considerations

📌 Government Subsidies Not Included – Solar and batteries benefit from subsidies, which could lower costs.

📌 Cloudy Days Not Accounted For – Real-world performance could require larger battery storage.

📌 One-Day Model Used – Seasonal and geographic variations would affect performance.

📌 Winter Capacity Factor Assumed – Excess solar capacity in summer could go unused.

📌 Short-Duration Batteries (2-4 Hours) Used – Long-duration batteries, if developed at scale, could change the equation.

Conclusion

While solar and batteries are improving, the cost and reliability gap between them and natural gas remains massive.

For AI companies making billion-dollar power decisions, the choice is simple: they need affordable, around-the-clock electricity, and right now, natural gas delivers that far more efficiently than solar and batteries alone.

Great article!