Texas Winds: Navigating the Unpredictable Grid

“Life is like a box of chocolates, you never know what you’re gonna get.” – Forrest Gump

Introduction

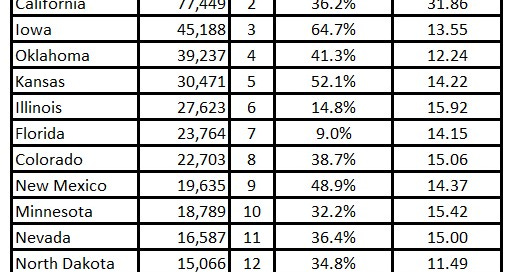

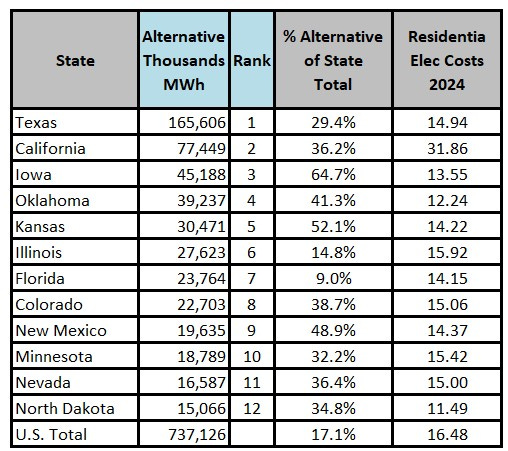

In July 2024, the Electric Reliability Council of Texas (ERCOT) projected a “slight risk” of Energy Emergency Alerts (EEAs) for summer 2025, particularly during late evenings when solar power fades and wind generation may weaken. This scenario, known as a Dunkelflaute—a German term meaning “dark doldrums” or “dark wind lull”—describes periods of low wind and solar output. While typically a winter issue elsewhere, Texas faces this threat in summer, endangering grid reliability. As the nation’s leader in renewable energy, Texas generated 29% of its electricity from wind and solar in 2024, producing over twice the megawatt-hours (MWh) of second-ranked California. Yet, like Forrest Gump’s box of chocolates, wind generation’s unpredictability challenges grid operators. Using 2024 data, this analysis explores wind variability, its impact on ERCOT’s grid, and the vital role of weather forecasting in preventing energy shortages.

Why Texas Matters

Texas is the heart of U.S. renewable energy, leading in wind and solar generation with 165,606 MWh in 2024, compared to California’s 77,449 MWh (EIA Electric Grid Monitor, 2024). Although California has a higher renewable share (36% vs. Texas’s 29%), Texas’s massive output and rapid growth make it a model for renewable integration. As other regions scale up clean energy, Texas’s successes and struggles—especially the risk of Dunkelflaute events—offer critical lessons. Its isolated grid, disconnected from national networks, heightens the stakes of balancing supply and demand, making reliability a high-wire act.

Wind Generation Trends in 2024

Daily Variability

Each dot represents one day of wind generation for ERCOT in the past year. Wind generation in Texas is as unpredictable as a gusty day. In 2024, daily output ranged from 2,000 MWh on calm days to over 25,000 MWh on windy ones (EIA Electric Grid Monitor, 2024). Summer months had fewer “very high wind days” (above 20,000 MWh) due to calmer weather patterns driven by high-pressure systems. This variability complicates reliance on wind during peak demand, such as sweltering summer evenings when air conditioners run full blast.

Monthly and Annual Averages

Monthly data reveals seasonal shifts. April 2024 was the windiest month, averaging 16,800 MWh daily, while September was the calmest, averaging 8,300 MWh—a 50% drop (EIA Electric Grid Monitor, 2024). This plunge from spring to fall signals that late summer and early autumn are prone to low wind output, raising the risk of Dunkelflaute events. Grid operators must plan for these lean months to avoid shortages.

Hourly Patterns in September 2024

September 2024’s hourly wind patterns were erratic, like a rollercoaster. Output typically peaked around midnight and dipped at 11 AM, with some days swinging by 16,800 MWh (EIA Electric Grid Monitor, 2024). For example:

September 17, 2024: Highest variability, fluctuating by 16,800 MWh in a single day.

September 21, 2024: A strong wind day, with consistent high output.

September 29, 2024: A low wind day, with minimal generation.

These swings, combined with fading solar power in the evening, demand reliable backup sources to keep the lights on.

The Challenge of Grid Scheduling

Managing Texas’s grid is like conducting an orchestra where the wind section plays unpredictably. Wind and solar can supply 0–80% of hourly electricity, depending on weather (ERCOT Grid and Market Conditions, 2024). Schedulers rely on forecasts for wind (based on speed), solar (based on cloud cover), and demand (driven by temperature), but predictions often miss the mark. On September 15, 2024, wind and solar output fell 10% below forecasts for several hours, forcing last-minute adjustments (ERCOT Grid and Market Conditions, 2024). These errors stem from complex weather patterns, like sudden wind shifts or unexpected clouds, which current models struggle to predict.

Schedulers calculate net load (total demand minus renewable contributions) to determine how much dispatchable load (e.g., gas or coal plants) is needed. They also maintain Physical Responsive Capability (PRC), a reserve of standby power for mechanical failures or forecast errors. Shown as an example is the PRC for yesterday (GridStatus, 2024). Texas added 2 GW of battery storage in 2024, which helps bridge short-term gaps by releasing stored energy quickly. However, extended Dunkelflaute events—lasting over 24 hours—can outlast battery capacity, requiring traditional power plants as backup.

Conclusion

Texas’s renewable energy leadership comes with growing pains. The 2024 data confirms ERCOT’s concerns: wind generation varies wildly, with daily swings of tens of thousands of MWh, monthly averages dropping 50% from spring to fall, and hourly fluctuations straining operations. September’s low output and erratic patterns underscore the Dunkelflaute risk, especially during high-demand summer evenings. As Ed Ireland warned in “Beware of the Texas Dunkelflaute” (July 2024), these challenges are real and recurring.

To prevent shortages, Texas must maintain sufficient dispatchable power, like gas plants, though this raises costs and emissions. Innovations—such as AI-driven weather forecasting, expanded battery storage, or demand response programs that incentivize lower usage during peaks—could ease the strain. As the nation’s renewable pioneer, Texas’s ability to tame its unpredictable winds will shape the future of clean energy. Like Forrest Gump’s chocolates, wind generation may surprise, but with smart planning, Texas can ensure a sweeter outcome for its grid.

Sources:

Daily and Hourly data is from EIA Electric Grid Monitor: Daily and hourly wind generation data for 2024.

ERCOT Grid and Market Conditions: Forecast and actual wind/solar data.

GridStatus: Net load and Physical Responsive Capability data

Ireland, Ed. “Beware of the Texas Dunkelflaute: ERCOT Warns Slight Risk of Emergency Alert in July.”

Monthly Outlook for Resource Adequacy (MORA) Reporting Month: For July 2025