"Do New York and New England Need the Constitution and Northeast Supply Enhancement Pipeline Projects?"

With soaring energy prices and growing demand, can New York and New England afford to delay critical natural gas infrastructure like the Constitution and Northeast Supply Enhancement Projects?

The Williams pipeline company is revisiting plans to construct two natural gas pipelines—the Constitution Pipeline and the Northeast Supply Enhancement Project (NESE)—to deliver natural gas to New York and the broader Northeast, spurred by a directive from President Trump. Despite New York Governor Kathy Hochul’s denial of a direct “horse trade,” her approval of the pipeline aligns with Trump’s decision to permit limited offshore wind development. This development has sparked debate about the necessity and implications of these pipelines. This article addresses four critical questions surrounding the projects:

What is the proposed Constitution Pipeline?

Is the natural gas supply available?

Is the natural gas demand sufficient to warrant the pipelines?

Are natural gas prices in New York and New England aligned with those in Pennsylvania’s production basin?

1. What is the proposed Constitution and NESE Pipeline?

Stretching approximately 125 miles from the gas-rich fields of Susquehanna County, Pennsylvania, to Schoharie County, New York, the Constitution Pipeline is more than just a piece of infrastructure. It’s a lifeline designed to deliver up to 650,000 dekatherms of natural gas pipeline capacity. That’s enough natural gas equivalent to serve the daily needs of about 3 million homes in the U.S. Northeast. This 30-inch pipeline links directly to the Iroquois and Tennessee interstate systems, opening a vital corridor of energy to the Northeast.

Complementing the Constitution Pipeline, the NESE project aims to deliver additional gas to New York City and Long Island, further addressing regional shortages.

Williams’ NESE project is an expansion of the existing Transco natural gas pipeline system, which already serves as a critical energy artery stretching through Pennsylvania, New Jersey, and New York. As demand continues to grow, especially in densely populated areas like Brooklyn, Queens, Staten Island, and Long Island, so too must the capacity to deliver reliable energy.

In response, the project is set to deliver by increasing the system capacity by about 400,000 dekatherms per day. That’s enough natural gas equivalent to meeting the daily needs of approximately 2.3 million homes, reinforcing the region’s energy resilience and supporting its continued growth.

2. Is the Natural Gas Supply available?

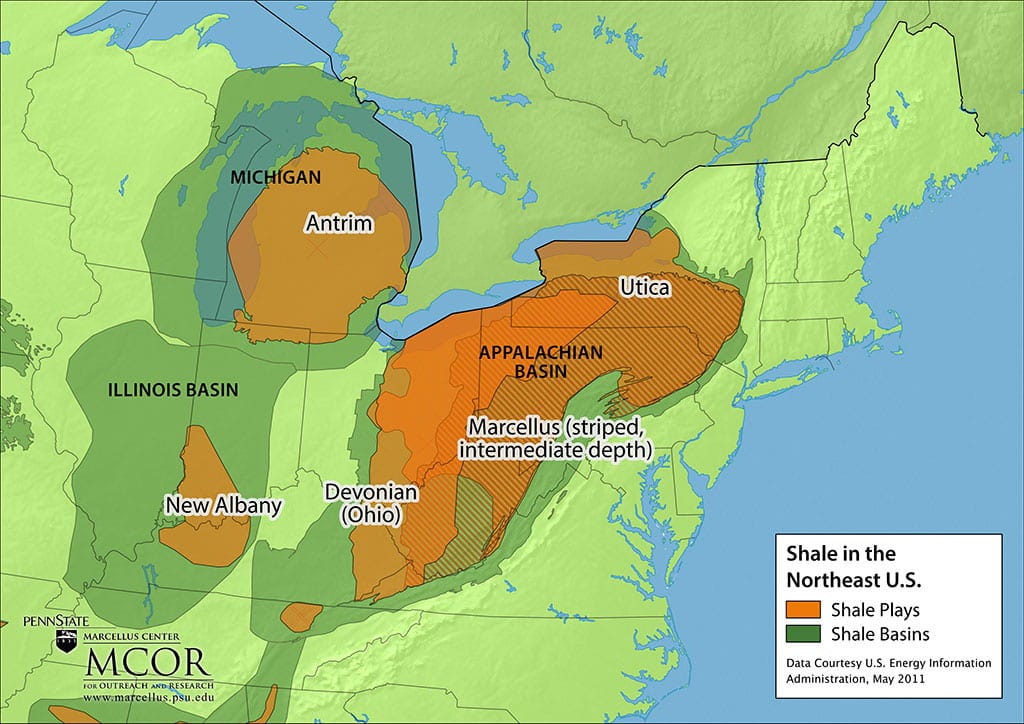

The Marcellus/Utica formations, spanning Pennsylvania, Ohio, and West Virginia, are the most productive natural gas regions in the U.S., accounting for roughly one-third of the nation’s daily output. Production in these regions surged from less than 2 billion cubic feet per day (Bcf/d) in the early 2010s to over 33 Bcf/d by the end of the decade, demonstrating ample supply to support new pipelines.

Figure 1 - 2024 U.S. Natural Gas Production and Withdraw

Although the Marcellus formation extends into New York, the state has opted not to develop its reserves, relying instead on imports. New York banned hydraulic fracturing in 2015, opting to import gas rather than develop its Marcellus reserves, increasing dependence on pipelines like Constitution and NESE.

New England sources most of its natural gas from New York, New Jersey, or Canada, with minimal Canadian imports. Due to the Jones Act, which mandates U.S.-built and -operated vessels for domestic shipping, New England relies on costlier foreign LNG imports, such as 87% from Trinidad and Tobago in 2023.

3. Is the natural gas demand sufficient to warrant the pipelines?

Electric Generation with Natural Gas

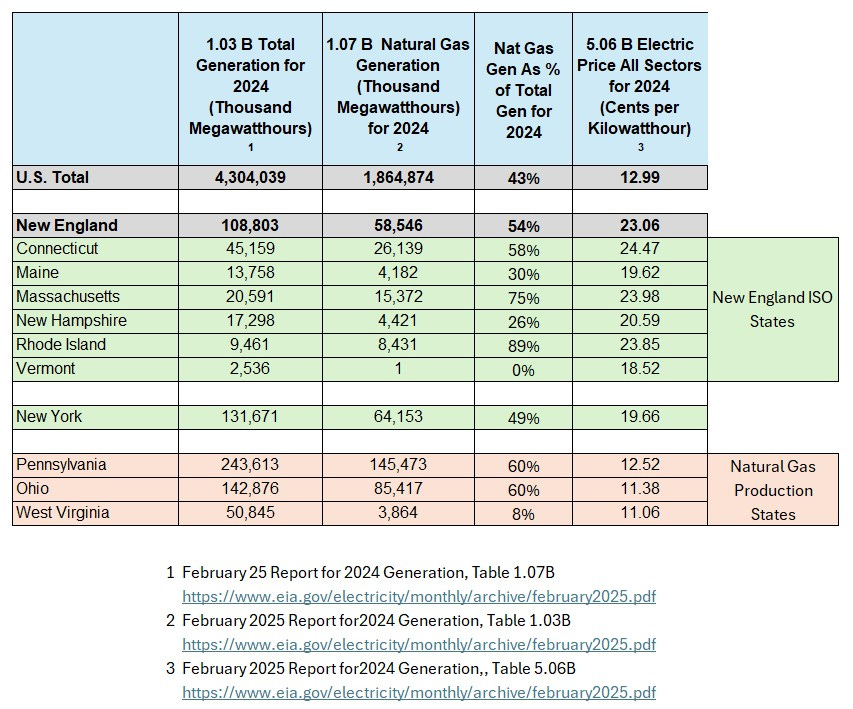

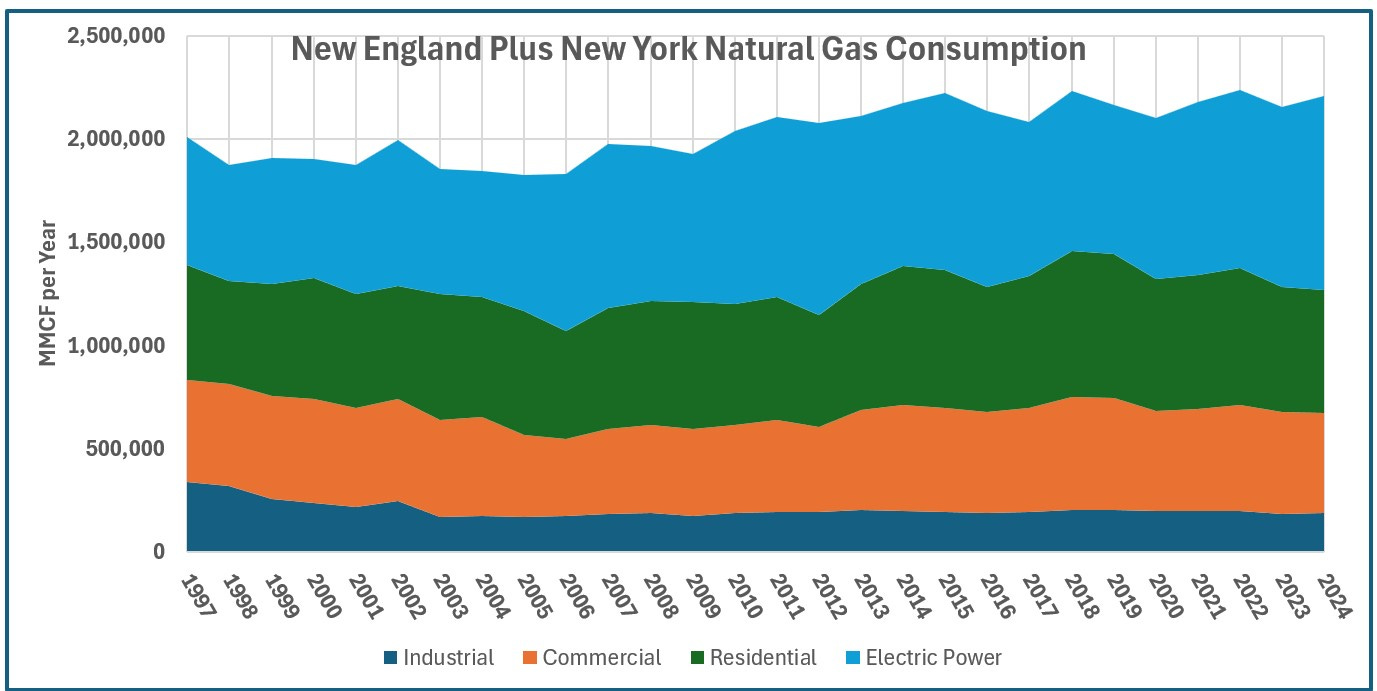

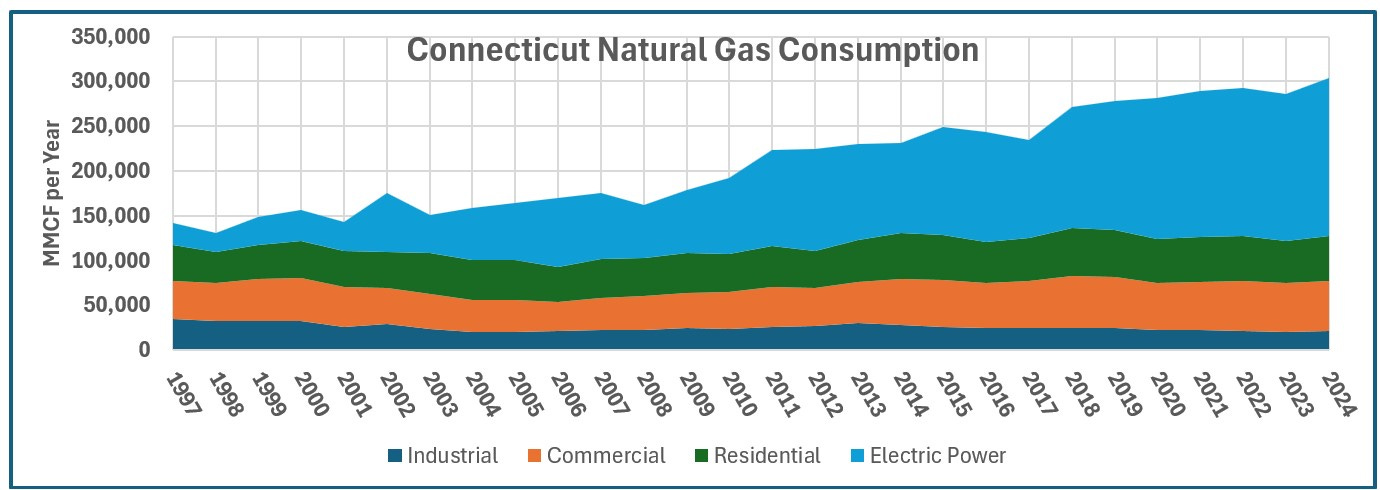

Natural gas demand in New York and New England remains robust, driven by its use in electricity generation, residential heating, commercial operations, and industrial processes. In New England, states like Connecticut, Massachusetts, and Rhode Island generate over half of their electricity from natural gas, significantly above the national average. New York generates 49% of its electricity from natural gas.

Despite the push for renewable energy, natural gas demand has not declined significantly. Electric power generation increasingly relies on natural gas, while industrial demand has slightly decreased, keeping overall demand stable since 2013.

Connecticut, in particular, has seen a sharp increase in natural gas use for electricity generation.

High electricity prices in New England—roughly double the U.S. average—are partly attributable to constrained natural gas supply, underscoring the need for additional pipeline capacity.

4. Are Natural Gas Prices in New York and New England Aligned with Pennsylvania’s Production Basin?

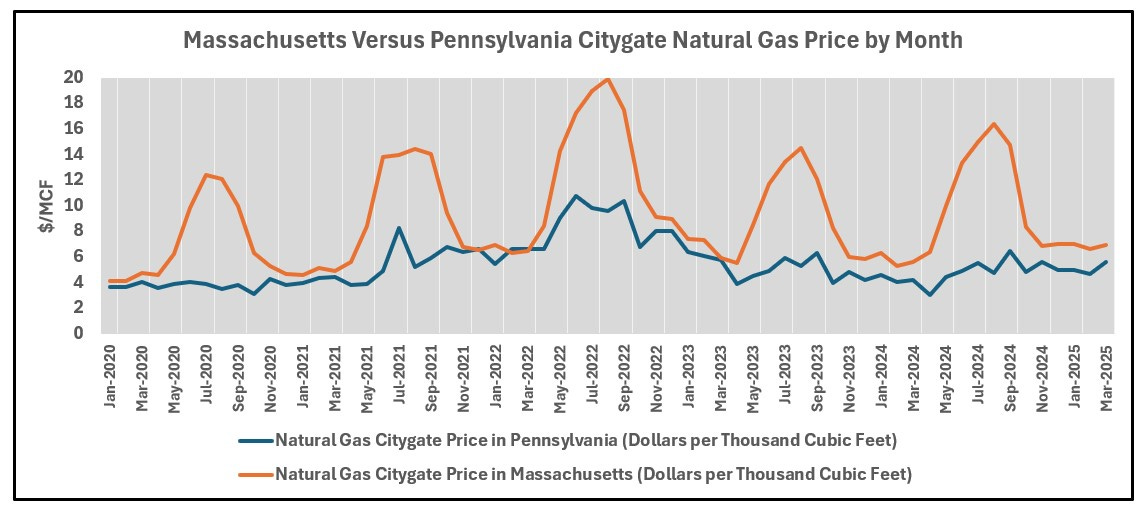

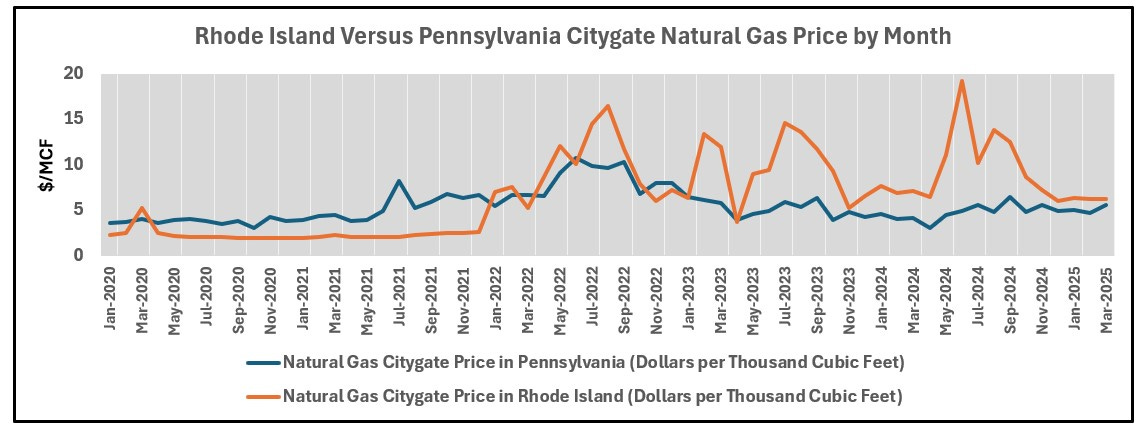

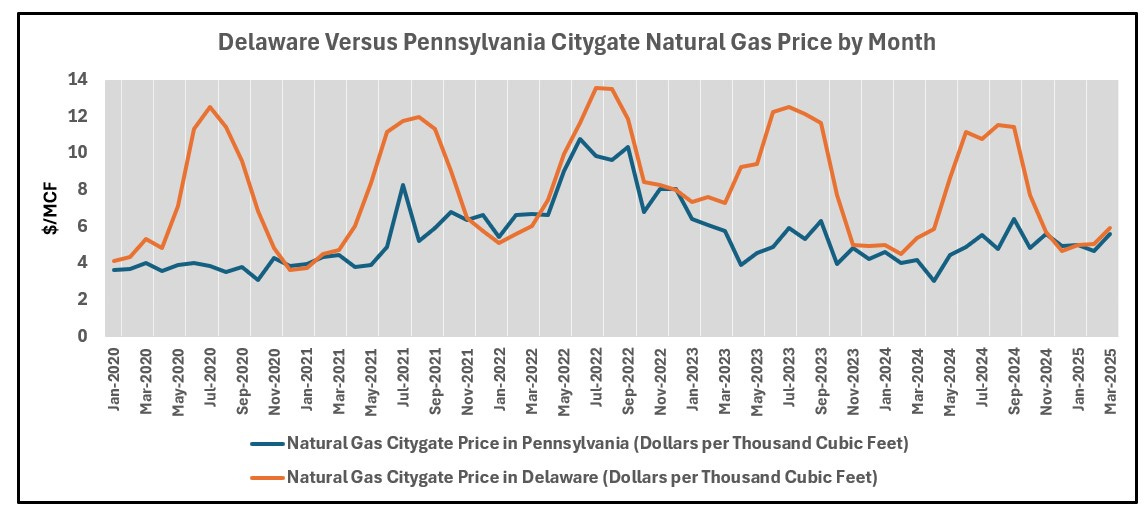

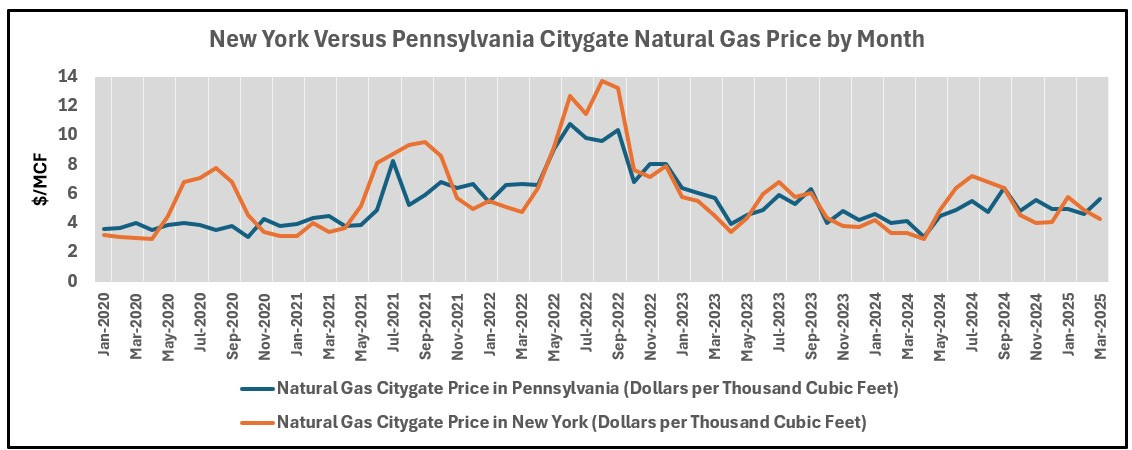

Natural gas prices in New York and New England are significantly higher than in Pennsylvania due to pipeline constraints. Using Citygate prices (the cost of gas as it enters local distribution systems), price disparities become evident during periods of high demand. In some months, New England states pay up to several times more per unit of natural gas than Pennsylvania.

These price differentials reflect the region’s reliance on limited pipeline capacity and imported LNG, which is costlier than domestic gas. New York experiences less severe price impacts than New England but plays a critical role in restricting gas flow to the region.

Conclusion

The Marcellus and Utica regions offer a plentiful and accessible natural gas supply to meet the needs of New York and New England. Stable and growing demand, particularly for electricity generation, justifies the development of the Constitution Pipeline and NESE projects. The significant price disparities between Pennsylvania and the Northeast highlight the region’s pipeline constraints, which drive up energy costs for residents, businesses, and industries. By expanding pipeline infrastructure, New York and New England can reduce energy costs, enhance energy security, and support economic growth.

Policymakers, industry leaders, and communities must weigh the environmental concerns associated with pipeline development against the urgent need for affordable and reliable energy. Engaging in transparent dialogue and exploring mitigation strategies can pave the way for balanced solutions. For more information on regional energy challenges, refer to related discussions, such as “New England ISO: A Self-Inflicted Energy Crisis.”

Just out today from EIA, 6/23/25, Residential electricity bills could increase slightly this summer.

"Residential bills are higher in New England because the typical price per kilowatthour is higher than in other regions because the cost of natural gas delivered to power generators in that region tends to be higher than other areas of the country."

https://www.eia.gov/todayinenergy/detail.php?id=65544&utm_medium=emai