Let’s call it what it is: there’s been no real “energy transition.” It’s more like “energy addition”—a sprinkle of wind and solar piled onto a heap of ever-growing conventional power. Science hasn’t budged, but Larry Fink has. Over five years, the BlackRock CEO’s annual letters reveal a striking pivot—from cheerleading renewables as the green future to admitting their limits with a pragmatism that borders on brutal. Buckle up: here’s how Fink’s energy gospel evolved.

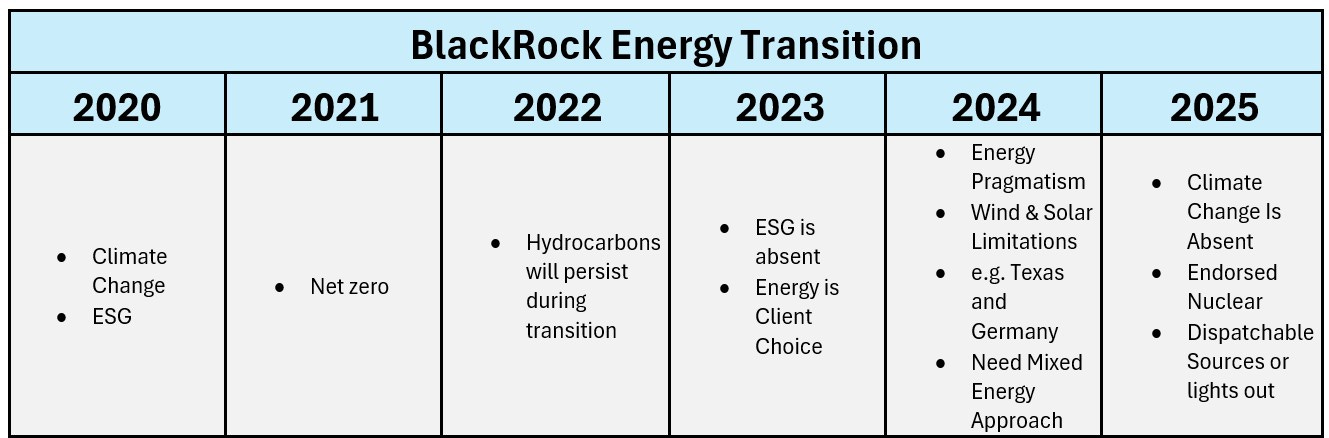

2020: The Green Dream Takes Flight

In 2020, Fink’s letter to CEOs declared climate change the “defining factor” for corporate survival, promising a “fundamental reshaping of finance.” Sustainability wasn’t just a buzzword—it was BlackRock’s mission. He vowed to ditch high-risk bets like thermal coal and nudge firms toward a net-zero economy. Wind and solar? The unspoken heroes of this renewable revolution. Climate risk doubled as investment risk, and Fink sold renewables as both planet-saving and profit-savvy—a win-win in the heyday of green investing.

2021: Net-Zero or Bust

By January 2021, Fink doubled down. He demanded companies align with a “net-zero economy” by 2050—emitting no more CO2 than they scrub out, per the Paris Agreement. Wind and solar stayed center stage, the golden children of a fossil-fuel exodus. It was bold, it was urgent, and it screamed ambition.

2022: Reality Bites

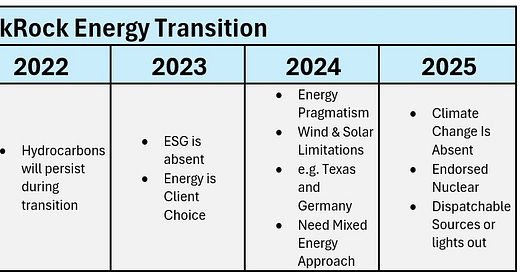

Then came 2022, and a splash of cold water. Russia’s invasion of Ukraine jolted energy markets, and Fink’s letter admitted the net-zero dream might stall short-term—but could speed up long-term. Wind and solar held their spot, but he nodded to hydrocarbons lingering in the mix. “Stakeholder capitalism” and profits took priority, and while renewables shone, Fink stopped short of claiming they’d dethrone fossil fuels anytime soon. Complexity crept in.

2023: ESG Goes Quiet

Cue the 2023 backlash. With ESG under fire, Fink’s letter ditched the term entirely. Climate talk faded; client choice and fiduciary duty took over. Wind and solar? Still in the game, but less a crusade, more a calculated bet. Oil and gas got a louder shout-out, hinting renewables couldn’t yet carry the world’s energy load solo. The vibe: cautious, not preachy.

2024: Enter “Energy Pragmatism”

By 2024, Fink pivoted hard. “Energy pragmatism” debuted, and he didn’t mince words: “Without major breakthroughs in storage, wind and solar alone can’t reliably keep the lights on.” Texas and Germany—where renewable-heavy grids lean on gas to avoid blackouts—became his exhibits A and B. Renewables were “cheaper in many places” and climate-critical, sure, but nuclear and dispatchable power were now must-haves. Texas’s ESG-driven divestment from BlackRock likely sharpened this edge. The rosy glow of 2020 was gone.

2025: Brutal Honesty

Fink’s 2025 letter (hot off the press!) doubles down. Climate change barely gets a mention; decarbonization ties instead to industrial muscle—think China’s nuclear sprint. Wind and solar? “Insufficient” for surging demands like AI data centers. “More than half the electricity powering data centers must come from dispatchable sources,” he warns, or “the air conditioning shuts off, servers fry, and the lights go out.” It’s less ideology, more survival.

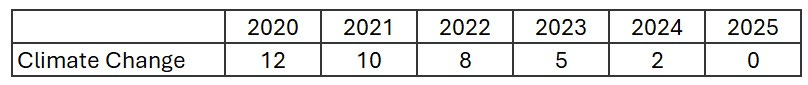

The Numbers Don’t Lie

One crude but telling metric? Fink’s “climate change” mentions per year:

2020: All-in.

2025: Barely a whisper.

Conclusion: From Evangelist to Realist

Fink’s journey is stark. In 2020, he preached wind and solar as the future—green, scalable, inevitable. By 2025, he’s a realist, wrestling with intermittency, grid failures, and political heat. Early hype crashed into hard truths: renewables can’t yet stand alone. His letters now juggle their long-term promise with today’s need for reliable power, mirroring BlackRock’s duty to clients and a retreat from absolutist climate vows. The “transition” isn’t dead—it’s just getting real.